Cumulative Preferred Stock: Definition, Feature, And How Does It Work?

Assume that you issue preferred shares with a $5 per share annual dividend that begins in 2017. In 2019 and 2020, your business suffers a downturn and suspends dividend payments. In 2021, your business recovers and you are able to restart dividend payments. Because par values are not the same as trading values, you have to pay attention to the trading price of preferred shares as well. If the preferred stock from the example above is trading at $110, its effective dividend yield would decrease to 4.5%. If a company is not willing or able to pay a dividend for a preferred stock in a given quarter, though, you may be eligible for back payment.

Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. Our editorial team does not receive direct compensation from our advertisers. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Kiplinger is part of Future plc, an international media group and leading digital publisher.

While we adhere to strict

editorial integrity,

this post may contain references to products from our partners. The offers that appear on this site are from companies that compensate us. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. Noncumulative dividends, on the other hand, can be missed without penalty. If a company decides that it can’t pay a dividend, it can choose to skip paying that dividend.

The Disadvantages of Preferred Shares

Preference shares, also known as preferred shares, are a type of security that offers characteristics similar to both common shares and a fixed-income security. The holders of preference shares are typically given priority when it comes to any dividends that the company pays. In exchange, preference shares often do not enjoy the same level of voting rights or upside participation as common shares.

This feature gives investors flexibility, allowing them to lock in the fixed return from the preferred dividends and, potentially, to participate in the capital appreciation of the common stock. If the firm apb meaning: what does apb stand for lacks the funds to pay preferred shareholders, its board of directors can suspend dividend payments indefinitely. This is a relatively drastic measure and would send a chilling message to all stakeholders.

Example of Convertible Preferred Stock

A company might recall and reissue a preferred stock to reduce the dividend payment to match current interest rates. Though preferred stock often has greater rights and claims to dividends, this type of investment often does not appreciate in value as much as common stock. In addition, preferred stock holders have little to no say in the operations of the company as they often forego voting capabilities.

However, participatory shares guarantee additional dividends in the event that the issuing company meets certain financial goals. If the company has a particularly lucrative year and meets a predetermined profit target, holders of participatory shares receive dividend payments above the normal fixed rate. Preferreds have fixed dividends and, although they are never guaranteed, the issuer has a greater obligation to pay them.

Participatory Preferred Shares

Preferred shareholders have priority over common stockholders when it comes to dividends, which generally yield more than common stock and can be paid monthly or quarterly. These dividends can be fixed or set in terms of a benchmark interest rate like the London InterBank Offered Rate (LIBOR), and are often quoted as a percentage in the issuing description. Cumulative preferred stock is an equity instrument that pays a fixed dividend on a predetermined schedule, and prior to any distributions to the holders of a company’s common stock. The amount of the dividend is usually based on the par value of the stock. Thus, a 5% dividend on preferred shares that have a $100 par value equates to a $5 dividend. An individual investor looking into preferred stocks should carefully examine both their advantages and drawbacks.

- And, yes, they could very well deserve a place in your portfolio, complementing, say, your allocations to dividend stocks and fixed income investments.

- Either of these may be different from the market price you paid for the preferred stock.

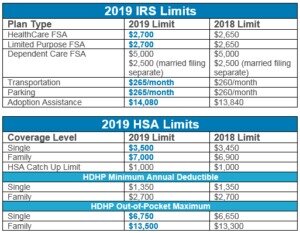

- Rules from the Internal Revenue Service (IRS) make it attractive for institutions to invest in preferred stock.

- First, preferred stock receive a fixed dividend as dividend obligations to preferred shareholders must be satisfied first.

Cumulative shares have a special right that allows them to accumulate undeclared dividends. The cumulative shareholders are guaranteed a certain amount of dividends each year, but this amount isn’t always paid out. Any dividends that aren’t paid out go into the savings account called dividends in arrears and will be paid out in future years before any common shareholders can be paid.

Advantages of preference shares

Common stockholders, on the other hand, may not always receive a dividend. A company may fully pay all dividends (even prior years) to preferred stockholders before any dividends can be issued to common stockholders. The day-to-day implication of this claim is that preferred shares guarantee dividend payments at a fixed rate, while common shares have no such guarantee. In exchange, preferred shareholders give up the voting rights that benefit common shareholders. Unlike a bond coupon, a preferred or common dividend can be omitted, typically when a company’s finances are tight, without putting the company into default and possibly into bankruptcy.

Public Storage’s 3.950% Cumulative Preferred Share Series Q … – Nasdaq

Public Storage’s 3.950% Cumulative Preferred Share Series Q ….

Posted: Wed, 02 Aug 2023 18:50:00 GMT [source]

This can be especially lucrative for preferred shareholders if the market value of common shares increases. Preferreds technically have an unlimited life because they have no fixed maturity date, but they may be called by the issuer after a certain date. The motivation for the redemption is generally the same as for bonds—a company calls in securities that pay higher rates than what the market is currently offering.

Only after preferred stockholders have been paid in full can common shareholders receive any money. In addition, cumulative preferred stock provides additional advantages over and above the non-cumulative type. This is before other classes of preferred stock shareholders and common shareholders can receive dividend payments.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

What Is Preferred Stock, And Should I Buy It?

Also, as is the case with bonds, the redemption price may be at a premium to par to enhance the preferred’s initial marketability. Preferred stock often has a callable feature that allows the issuing corporation to forcibly cancel the outstanding shares for cash. This precludes the investor from participating in any future price appreciation. It also doesn’t specify the maturity date which injects uncertainty over the recovery of invested principal. There is limited appreciation potential, no voting rights and it is sensitive to interest rates. Preferred stock is often described as a hybrid security that has features of both common stock and bonds.

If the corporation owns more than 20% of the dividend payer, it can deduct 65%. There are income-tax advantages generally available to corporations investing in preferred stocks in the United States. Going back to the plus column, preferred stocks are transparent and convenient in a way that individual bonds are not. They trade on a stock exchange, which gives them price transparency and, importantly, liquidity. It’s also important to remember that securities with longer maturities are more sensitive to changes in interest rates. As such, preferred stock prices move in a narrower range, and tend to do so more on interest-rate risk or the issuing company’s credit risk.

However, stock proceeds from issuing cumulative preferred shares are considered to be an asset. Companies often issue cumulative preferred shares as a source of long-term financing that helps the companies to raise considerable finance. Cumulative Preferred Stocks are a type of preferred stock that abides the company to pay all the dividends for this type of shareholders before paying any other shareholder of the company. Common stock is the standard class that is made up of the owners who have voting rights and can control the future of the company. Conversions are most worthwhile when the underlying asset increases in value, so that an investor can convert preferred stock to common stock and realize the appreciation.

Preferred stock works well for those who want higher yields than bonds and the potential for more dividends compared to common shares. Preferred stock also usually differs from common stock in its voting rights. Owners of common stock usually have voting rights in the company, but owners of preferred stock rarely do. It will depend on how it is issued, and investors need to take notice before purchasing the stock, if that’s important to them. The upside potential of preferred stock is capped, whereas common stock has unlimited upside potential.

Participatory preference shares provide an additional profit guarantee to shareholders. All preference shares have a fixed dividend rate, which is their chief benefit. Once the shares have been exchanged, the shareholder gives up the benefit of a fixed dividend and cannot convert common shares back to preferred shares.